China Media and Entertainment Weekly News Bulletin – ISSUE 9 Week of 29 July 2024

(1) Alibaba’s Taobao, ByteDance’s Douyin Seek E-Commerce Price War Detente with New Policies

Alibaba and Douyin are shifting away from a sole focus on low pricing strategies towards a more sustainable approach.

(2) Tech War: China Narrows AI Gap with US Despite Chip Restrictions

Chinese tech companies are rapidly advancing domestic AI capabilities amidst chip supply restrictions.

(3) Nintendo and Sony Hamstrung in China by Thin Game Libraries

Japanese game giants Nintendo and Sony have struggled to gain significant traction in China’s massive video game market due to regulatory barriers.

(4) China Box Office: ‘Deadpool & Wolverine’ Opens in Second Place Behind Runaway Hit ‘Successor’

Both the Chinese comedy and the Hollywood superhero film had one of the best openings in China this year, although still below 2023 levels.

(5) China’s Robotaxi Dreams Spark Economic Anxiety Over AI’s Threat

Baidu’s “Apollo Go” faces challenges as China saw the rapid rollout of robotaxis amidst the country’s striving electric vehicles industry development.

(6) Hong Kong Retailers Hope to Strike Olympic Gold as Paris Sports Extravaganza Boosts Business

Hong Kong shopping centres live-streaming the Paris Olympics expect a 15% sales boast as the city celebrates its first gold medal win with fans flocking to centres and the Olympics fostering community spirit and increased shopping.

(7) Hong Kong Jockey Club Eyes Mainland Opportunities Despite Betting Ban

The HKJC is investing $1 billion to transform a Guangzhou facility into a racecourse as it aims to expand its presence in China by 2024 despite gambling restrictions.

(8) World’s Top Auction Houses Racing to Expand in Hong Kong Despite Economic Slowdown

Top auction houses are expanding in Hong Kong despite global art sales drop.

(9) Hong Kong’s Elite Athlete Rewards

Hong Kong fencer Cheung Ka Long successfully defended his Olympic fencing title, earning over HK$13.5 million in prize money and monthly training subsidies.

(1) Alibaba’s Taobao, ByteDance’s Douyin Seek E-Commerce Price War Detente with New Policies

(Photo Credit: Shutterstock)

China’s top e-commerce platforms Alibaba and ByteDance’s Douyin are adjusting their business model by shifting away from the sole focus on low pricing strategies in favour of a “good items with good prices” approach. Such adjustments include not labelling their products as “the cheapest online”.

This came after a recent report from 36kr, a Chinese tech news site, that Douyin had missed its first-half sales target partly due to the intense price war within the online retail industry, although a representative from Douyin said the report was inaccurate.

On the other hand, Alibaba is also seeking to de-emphasise having the lowest price and competing on price primarily, and instead to favour merchants by waiving annual software service fees as well as to offer merchants who have “good track records” with more autonomy in their handling of customer’s refund requests.

This marks a shift in China’s e-commerce landscape which had become highly competitive in recent years and into a more sustainable online shopping ecosystem.

(2) Tech War: China Narrows AI Gap with US Despite Chip Restrictions

(Photo Credit: Reuters)

Chinese entities, including Alibaba, have been contributing to the progress of artificial intelligence (“AI”) technologies within the country, a development that is narrowing the AI gap between China and the US.

Such efforts include creating their own large language models (“LLMs”) with the standards that, many claiming, match or exceed their counterparts in the US.

For example, in June Alibaba Group Holding released its open-sourced LLM family Qwen2 which the co-founder and CEO of the developer community for open-source AI models, “Hugging Face”, claimed that Qwen2 is “king” and that “Chinese open models are dominating overall”. Another example is Huawei Technologies’ Ascend solution which a Beijing-based technical consultant described to be China’s best-shot in developing its own home-grown AI-infrastructure.

Moreover, the US has restricted access by China to advanced chips which are critical to training AI systems. As a result, China has been seen creating locally developed solutions in building what is now a large reservoir of intelligent computing power required to train their own LLMs.

(3) Nintendo and Sony Hamstrung in China by Thin Game Libraries

(Photo Credit: Itsuro Fujino)

Japan’s Nintendo and Sony have struggled to gain a significant foothold in China’s massive $4.2 billion video game market as they face regulatory barriers that restrict the approval of most of their video games.

On the other hand, major Chinese game companies such as Tencent had been prominent at the recent gaming expo “ChinaJoy”. Consumers in China had also expressed preference for local games over Japanese games citing more interesting narratives within their domestic options.

Major consoles such as Switch (in partnership with Tencent), PlayStation 4 and PlayStation 5 have been released over the years in the Chinese market, although a limited growth had been experienced so far.

Nevertheless, the local arm of Sony Interactive Entertainment expressed that there are plans to release more games to the market upon receiving “greenlights” from the regulators, while Nintendo also expressed that it will “strive to demonstrate Tencent’s and our appeal”.

News Source: https://asia.nikkei.com/Business/Media-Entertainment/Nintendo-and-Sony-hamstrung-in-China-by-thin-game-libraries

(4) China Box Office: ‘Deadpool & Wolverine’ Opens in Second Place Behind Runaway Hit ‘Successor’

(Photo Credit: Marvel Studios/Deadpool Twitter)

The Chinese comedy film “Successor” had strong box office performance in China, pushing its total gross over $300 million. The Hollywood superhero file “Deadpool & Wolverine” also had one of the best openings for a Hollywood movie in China so far this year, with over $23.9 million over the weekends, marking the second biggest opening weekend performance by any Hollywood film this year behind “Godzilla x Kong”.

Other notable performers included the Chinese film “The Traveller” debuting with $12.8 million, and “A Place Called Silence” earning $5.6 million in its fourth weekend, reaching a total of $174 million.

The total box office for the weekend was $113 million, bringing the yearly total in China to over $4 billion. However, this is still around 15% behind the same point in 2023.

News Source: https://variety.com/2024/film/box-office/china-box-office-deadpool-wolverine-weekend-debut-1236088542/

(5) China’s Robotaxi Dreams Spark Economic Anxiety Over AI’s Threat

(Photo Credit: Bloomberg)

China is a global leader in electric vehicle batteries and supply chain, and there is a rapid development in driverless taxi technology in the country. Yet, robotaxis such as Baidu’s “Apollo Go” is facing challenges following its rapid deployment, with residents complaining the vehicles drive too cautiously and cause traffic issues.

Wuhan had become the biggest proving ground for Baidu’s robotaxis, partly due to the less stringent regulatory approach adopted by the city’s authorities as compared to the other parts of China.

Nevertheless, there is a growing anxiety about the economic implications of driverless technology that the cities in China are embracing, particularly for ride-hailing drivers. Whilst Baidu is heavily subsidising fares to its customers to encourage an increase in its service, it has also been seen to be frustrating some taxi companies who expressed that such a strategy has gone too far. Analysts at JPMorgan Chase & Co. had also published a report on the pricing scheme strategy, describing it as commercially unviable and is “discouragingly deep loss-making robotaxis”.

News Source: https://www.bloomberg.com/news/articles/2024-07-31/china-s-robotaxi-dreams-sparks-anxiety-over-losing-jobs-to-ai

(6) Hong Kong Retailers Hope to Strike Olympic Gold as Paris Sports Extravaganza Boosts Business

(Photo Credit: SCMP; Elson Li)

Hong Kong shopping centres live-streaming the Paris Olympics have said they expect a 15 per cent sales boost over the course of the event compared with the same period last year as the city won its first gold medal.

Sports fans flocked to shopping centres on Saturday and stayed into the early hours of Sunday to cheer on the city’s athletes – including fencing queen Vivian Kong Man-wei, who took top spot on the podium in the women’s épée event.

According to the report, people being interviewed expressed that the Olympics encourage people to support Hong Kong athletes and by doing so brings people closer through a sense of community. Some interviewees say that the Olympics also encourage people to walk out and shop more, which is important to keep the market thriving.

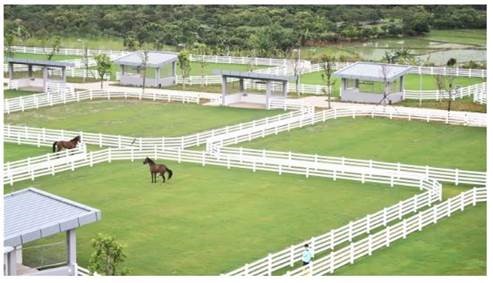

(7) Hong Kong Jockey Club Eyes Mainland Opportunities Despite Betting Ban

(Photo Credit: Nikkei; HKJC)

The Hong Kong Jockey Club is looking to expand its presence in mainland China, as it prepares to hold regular races there from 2026. With 8.5 billion Hong Kong dollars ($1 billion) of investment since 2015, the HKJC is transforming a training facility in Guangzhou’s Conghua District into a full-fledged racecourse.

Even though gambling on horse races is illegal in mainland China, the club could be able to find a way around the restrictions.

According to HKJC’s CEO, Winfried Engelbrecht-Bresges, there may be the opportunity adopt a model similar to overseas betting on other sports taking place in China, such as soccer matches. The HKJC’s push into Guangzhou, part of China’s Greater Bay Area, aligns with the Hong Kong and central governments’ drive for cross-border integration.

News Source: https://asia.nikkei.com/Business/Travel-Leisure/Hong-Kong-Jockey-Club-eyes-mainland-opportunities-despite-betting-ban

(8) World’s Top Auction Houses Racing to Expand in Hong Kong Despite Economic Slowdown

(Photo Credit: Supplied)

3 of the top auction houses – Sotheby’s, Christie’s, and Bonhams, are set to expand their regional headquarters in Hong Kong.

Speaking on the expansion plan, Sotheby’s managing director of Asia Nathan Drahi said “We are very confident in the prospect of Hong Kong because it possesses some strong fundamentals for our industry”. In doing so, Drahi referred to Hong Kong’s favourable tax framework.

While warning that risks come with the expansion plans, art adviser Patti Wong also stated that the auction houses are “putting their bets down and saying Hong Kong is the centre for Asia”

Notwithstanding the above, data showed that Christie’s has experienced its second consecutive year of decline since 2022, dropping from $4.1B in sales to this year’s $2.1B. In fact, global art sales have slowed since 2021. According to a former Christie’s auctioneer, China’s real estate crisis constitutes a major factor in the decline.

News Source: https://hongkongfp.com/2024/07/28/worlds-top-auction-houses-racing-to-expand-in-hong-kong-despite-economic-slowdown/

(9) Hong Kong’s Elite Athlete Rewards

(Photo Credit: Fabrice Coffrini/AFP)

Hong Kong’s fencing champion, Cheung Ka Long, successfully defended his Olympic title in Paris, earning a net prize of $6 million through the Jockey Club Athlete Incentive Awards Scheme. With this year’s increased rewards for gold, silver, and bronze winners, Cheung’s total prize money from two Olympics stands at HK$13.5 million, including the award from Lam Tai Fai College Alumni Programme.

In addition to his remarkable achievements at the Olympics, Cheung qualifies for substantial training subsidies, surpassing Hong Kong’s average monthly income by more than double. Expected to be categorized under the Elite Athlete Support Scheme Tier A+, he stands to receive HK$44,500 monthly, as per the 2023/24 data, excluding any extra support. The amount is more than double the latest monthly median income of Hong Kong people at HK$21,000.

News Source: https://www.hk01.com/article/1042787?utm_source=01articlecopy&utm_medium=referral