Asia Art Weekly News Bulletin – ISSUE 9 Week of 7 April 2025

Sam Altman defends AI-generated art as a societal benefit, despite criticism from Studio Ghibli’s Hayao Miyazaki.

(2) Art Auction Sales Dropped in 2024 Amid Global Volatility

The Art Basel and UBS Art Market Report 2025 reveals a significant decline in global art sales, the largest since the pandemic, with sellers increasingly opting for private transactions amid market volatility and rising trade tariffs, which may lead to higher prices and material changes.

(3) Hong Kong’s soon-to-open art-storage facility is another draw for family offices

The complex at Skytopia airport city will be ready this year or early next year and enhance Hong Kong’s role as an art-trading centre

(4) As Trump’s Tariffs Spark Global Trade Panic, Art Remains an Exception

While the art market is not immune to the wider economic effects of the tariffs, art imports shouldn’t be affected thanks to a First Amendment loophole.

(1) OpenAI CEO Sam Altman opens up on Studio Ghibli Founder’s “insult to life” criticism of AI‑generated art

(Photo Credit: Tomohiro Ohsumi/ Getty Images)

OpenAI CEO Sam Altman recently defended AI-generated art in response to criticism from Studio Ghibli co-founder Hayao Miyazaki, who labelled it an “insult to life.” In an interview, Altman acknowledged the downsides of AI art, such as job displacement and copyright concerns, but emphasised its overall positive impact on creativity.

Despite the backlash, Altman remains optimistic about the potential of AI in the creative field. He noted that while some artistic tasks might be taken over by AI, the demand for design could actually increase. OpenAI has taken steps to limit prompts that mimic Ghibli’s distinctive style, addressing concerns about copyright infringement and the unauthorised use of artists’ works.

The ongoing debate highlights the complexities surrounding AI-generated content, particularly in relation to copyright and the artistic community. With over 700 million images created through ChatGPT, the conversation about AI’s role in art continues to evolve, reflecting both the excitement and apprehension associated with these technological advancements.

News Source: https://timesofindia.indiatimes.com/technology/tech-news/openai-ceo-sam-altman-opens-up-on-studio-ghibli-founders-insult-to-life-criticism-of-ai-generated-art-it-has-not-been-a-complete-win-but-i-think-/articleshow/120097544.cms

(2) Art Auction Sales Dropped in 2024 Amid Global Volatility

(Photo Credit: Christie’s)

According to the Art Basel and UBS Art Market Report 2025 by Arts Economics, the total global art sales fell significantly compared to the previous year, with both dealer and public auction sales declining by 6% and 25%, respectively, in 2024. This downturn is the largest since the pandemic began in 2020 and highlights ongoing volatility in the market.

It was noted in the report that during uncertain market conditions, sellers often prefer private transactions for greater control over pricing and scheduling. This trend typically occurs when the market is perceived as volatile, leading sellers to opt for private sales rather than public auctions, where prices may be more unpredictable.

Also, the report indicates that the art market may face further challenges due to rising trade tariffs and macroeconomic pressures. These tariffs, particularly affecting imports from the European Union and China, could lead to higher prices and changes in the types of materials available.

News Source: https://hyperallergic.com/1002180/art-auction-sales-dropped-by-25-percent-in-2024-amid-global-volatility/

(3) Hong Kong’s soon-to-open art-storage facility is another draw for family offices

(Photo Credit: SCMP)

An art-storage facility at Hong Kong International Airport is set to be completed later this year or early next year, according to Jason Fong, the global head of family office at InvestHK. This facility is the final component of eight measures introduced over two years to create a supportive ecosystem for family offices in the city. Fong emphasised that it will provide wealthy families a secure, temperature-controlled space to store their art collections, helping to establish their family legacies.

The Airport Authority Hong Kong (AAHK) recently unveiled a blueprint for Skytopia, a new airport city featuring the art-storage facility along with other infrastructures like a marina, hotels, and a performance venue, aiming to position Hong Kong as a world-leading destination.

The new airport-storage facility will enable overseas buyers to inspect art, negotiate deals, and complete transactions efficiently, enhancing Hong Kong’s status as an art-trading centre. With a reported 50% increase in art trading in 2022, the city is poised to solidify its role as a global cultural hub, supported by high-net-worth individuals actively purchasing new works.

News Source: https://www.scmp.com/business/banking-finance/article/3305067/hong-kongs-soon-open-art-storage-facility-another-draw-family-offices

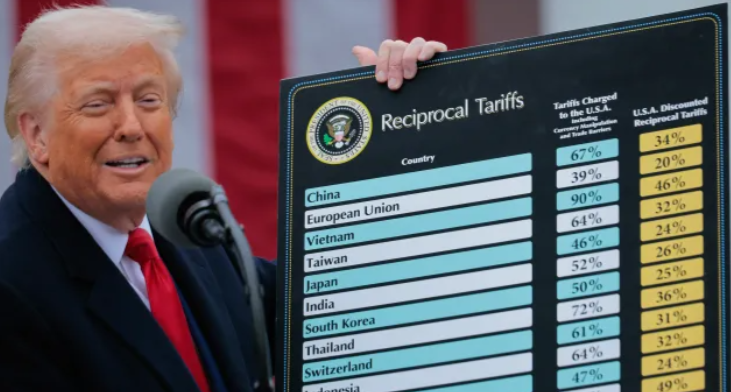

(4) As Trump’s Tariffs Spark Global Trade Panic, Art Remains an Exception

(Photo Credit: Chip Somodevilla/Getty Images)

On 2 April 2025, President Trump announced a series of tariffs that sent shockwaves through global markets, affecting various sectors, including the art market. The tariffs included a base level of 10% on imported goods from all countries, with significantly higher rates targeting major trading partners such as China, Switzerland, and the European Union. However, artworks have so far been exempted from these tariffs, due to a constitutional protection linked to the First Amendment, which safeguards the free movement of artistic expression across U.S. borders.

While the art market remains relatively protected for now, there are concerns that this protection could become vulnerable, especially as the broader economic climate shifts and regulatory pressures increase.

Despite the current exemptions, there are indications that the art market may face challenges ahead. As tensions escalate, some dealers are pre-emptively shipping artworks before new tariffs take effect, with many fearing that the upcoming art fairs in the U.S. could become more regional in nature. The uncertain economic landscape could ultimately reshape how art is traded and perceived, potentially pushing collectors toward more stable markets abroad.

News Source: https://observer.com/2025/04/liberation-day-trump-tariffs-art-exempt-stock-market-crash/